More and more businesses are transforming their marketing strategies to include influencer marketing as a primary channel, causing the volume of payments and new compensation processes for creators to increase. These organizations’ in-house finance departments are sometimes tasked with onboarding every creator as a vendor, a process that can be time-consuming or complicated, and often causes friction between internal teams. Additionally, businesses’ existing financial systems may not be prepared to scale creator payments, meaning that these organizations could face liabilities around data privacy, storage, audit risk, and transparency.

There are many factors that contribute to paying creators in a compliant way. In this blog post, we’ll review the essentials, making sure that your brand is prepared to gather the necessary paperwork and information from each of your creators, and properly handle the volume and complexity of paying them.

What tax forms do businesses need from creators?

Some creators work as independent contractors for the companies they promote. Independent contractors are considered self-employed, so they must pay self-employment tax as well as income tax. Meanwhile, other creators are sole proprietors who are self-employed and in business for themselves. These creators normally file taxes using their personal income tax returns and their social security number.

For U.S. residents, businesses in agreement with creators should collect a W-9 IRS form. For non-U.S. residents, a W-8BEN IRS form should be filled out to ensure tax compliance before paying a creator.

What personal identifiable information (PII) do businesses need to collect in order to pay a creator?

In order to pay a creator, businesses must gather the following information from them:- Name

- Email Address

- Signed W-9 (US)

- Signed W-8BEN (Outside US)

- Banking information, including account holder name, bank name, routing number, account number.

- The creator’s preferred method of payment, such as PayPal, direct deposit, or wire transfer, which can be optional or at the organization’s discretion.

What are the risks associated with non-compliant PII collection and storage?

Because businesses collect large quantities of PII data, they can be targeted by hackers who use this information for identity theft, fraud, and social engineering attacks. Over the years, various state and national governments have taken data collection to protect PII very seriously. California, for example, has implemented the California Consumer Privacy Act, which allows consumers to have more control over the information businesses collect about them. Meanwhile, the General Data Protection Regulation (GDPR) regulates how businesses process, protect, and transfer PII of European Union citizens.

To help businesses prevent fraud, a security breach, or a potential loss of their customers’ trust, the Federal Trade Commission (FTC) has provided a guide for businesses to protect personal information. The FTC advises organizations to secure data via five key principles:

- Take stock of all personal information stored in company computers, mobile devices, flash drives, or any other digital or print mechanism.

- Scale down the amount of information you keep, and only hold on to necessary data for your business.

- Lock and protect the information you keep through “physical security, electronic security, employee training, and the security practices of contractors and service providers.”

- Properly dispose of the sensitive information that you do not keep.

- Plan ahead and prepare guidelines for future security incidents.

As the FTC notes, safeguarding this information is plain good business. These practices can help organizations prevent phishing, digital attacks, regulatory fines, and loss of customer trust and loyalty.

How can enterprises collect creator PII and tax information while maintaining safety, compliance, and privacy?

Most influencer marketing campaigns move quickly, and new creators are sometimes onboarded before all internal departments have had time to process necessary information. Campaign managers might field creator payment and tax information via email or text, then store this information in local computers, spreadsheets, shared cloud drives, or other non-compliant locations. When there’s no established process or integrated system between an organization’s influencer marketing department and accounting team, businesses can struggle with compliant information gathering, detailed audit trails, and delays in payments to creators.

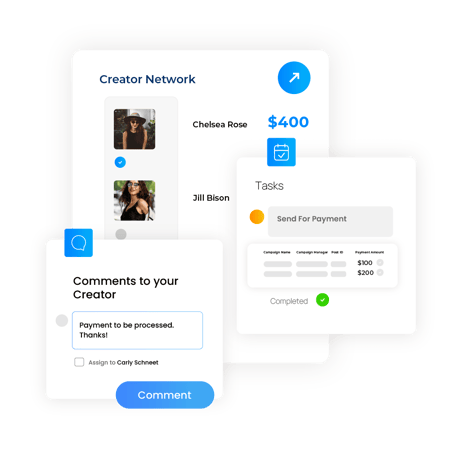

Enterprises can reduce tax and PII compliance and security risks by syncing their accounting and influencer marketing teams via a comprehensive, transparent solution for paying creators. This solution should ensure that organizations maintain data compliance as soon as creators are onboarded thanks to built-in, safe, and secure collection and storage of PII, including payment details and tax documents. Additionally, internal stakeholders should be able to get granular, enjoying direct visibility into payment statuses and centralized record keeping in order to gain an accurate view of creator costs and campaign ROI.

Everyone has a right to safety and privacy, and creators’ PII and tax information should be protected by best-in-class security. CreatorIQ offers the industry’s leading creator payments solution, with an integrated system spanning 190 countries and 120 currencies. CreatorIQ’s solution saves time during every step of the process, from W-9/W-8BEN collection to distributing 1099 and 1042 forms. With our automated system of tax filings, payments, and monthly reconciliations for accounting teams, businesses can rest easy.